Two common ways of reducing your tax bill are credits and deductions:

Current tax brackets 2021 usa how to#

How To Get Into A Lower Tax Bracket & Pay A Lower Federal Tax Income Rate

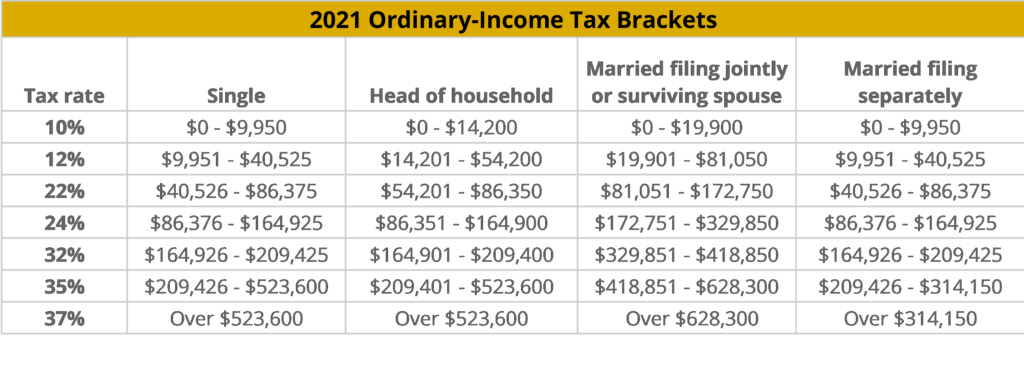

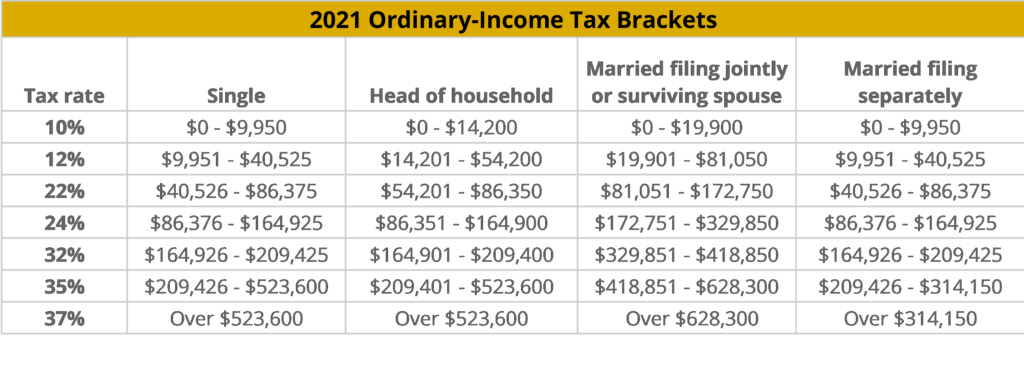

That’s the deal only for federal income taxes your state might have different brackets, a flat income tax or even no income tax at all. The total bill would be about $6,900 - about 14% of your taxable income, even though you’re in the 22% bracket. And then you’d pay 22% on the rest, because some of your $50,000 of taxable income falls into the 22% tax bracket. Example #2: If you had $50,000 of taxable income, you’d pay 10% on that first $9,525 and 12% on the chunk of income between $9,526 and $38,700. (Look at the tax brackets above to see the breakout.) Actually, you pay only 10% on the first $9,525 you pay 12% on the rest. That puts you in the 12% tax bracket in 2018. Example #1: Let’s say you’re a single filer with $32,000 in taxable income. The beauty of this is that no matter which bracket you’re in, you won’t pay that tax rate on your entire income. The government decides how much tax you owe by dividing your taxable income into chunks - also known as tax brackets - and each chunk gets taxed at the corresponding tax rate. The progressive tax system means that people with higher taxable incomes are subject to higher tax federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates. Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make. The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates. Single Filers Married, Filing Jointly Married, Filing Separately Head Of Household How Tax Brackets Work

Our table shows the tax brackets and federal income tax rates that apply to the 2018 tax year and relate to the tax return you’ll file in 2019. The bracket depends on taxable income and filing status. Keep up to date on the latest changes in the federal income tax brackets with Brilliant Tax.

0 kommentar(er)

0 kommentar(er)